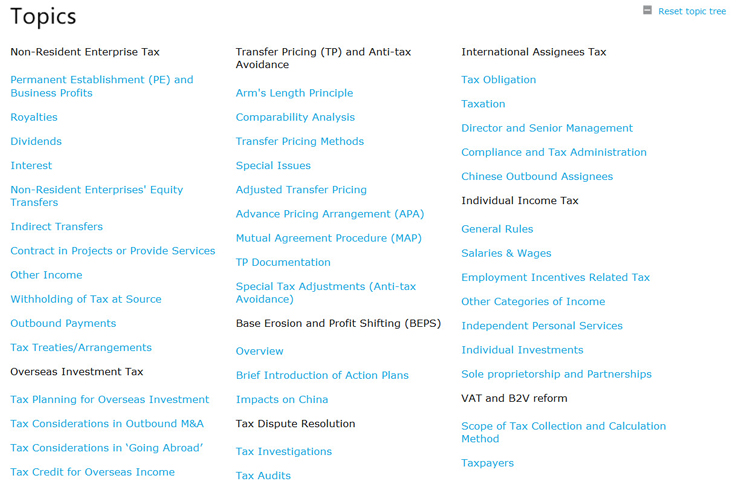

tax planning services introduction

An Introduction to Tax Planning Strategies. Digital technologies and advanced risk analytics for more profitable business decisions.

Income Tax Preparation Small Business Accounting Dartmouth Ma 508 496 7168

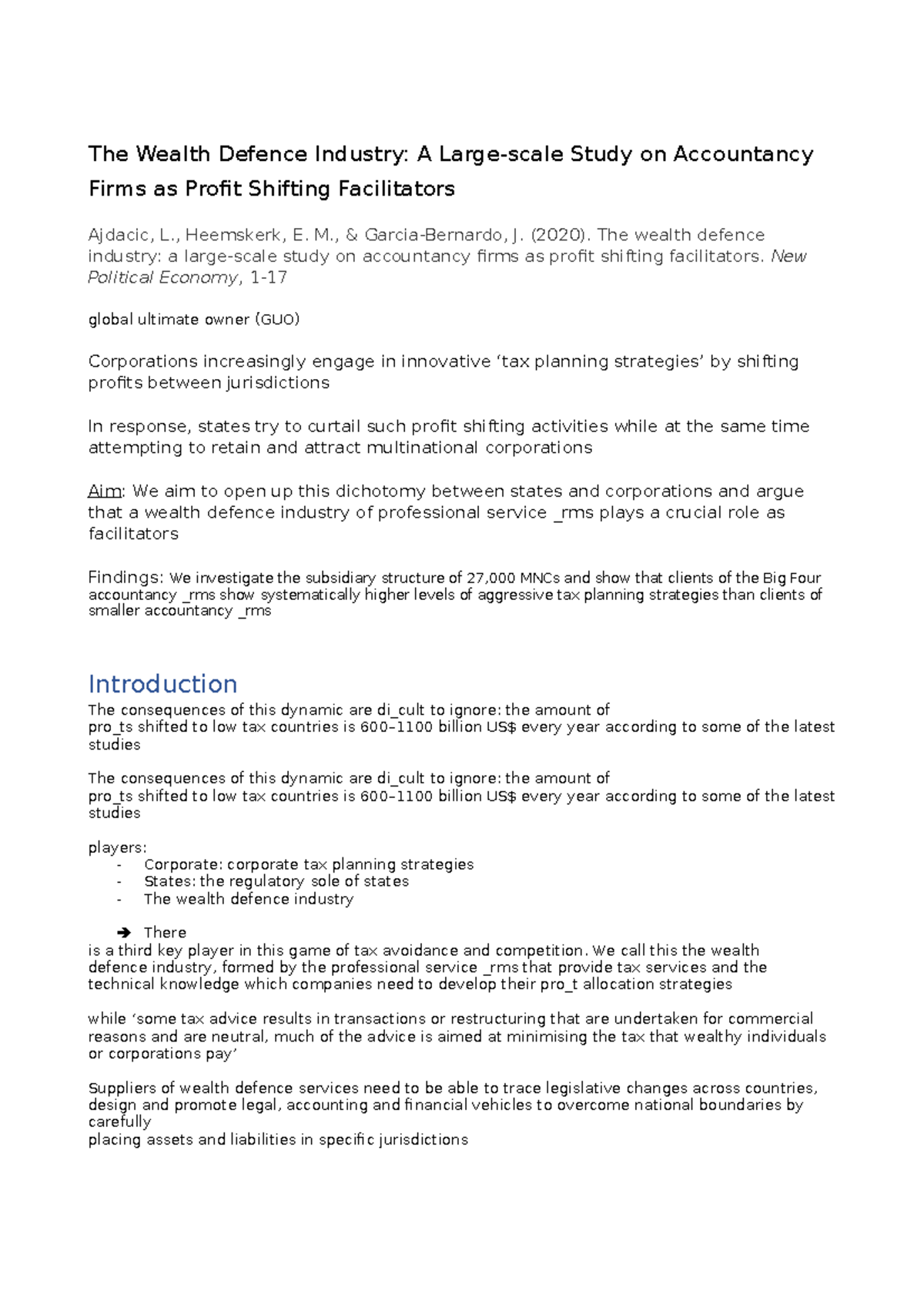

We have seen an ongoing approach to artificial tax avoidance.

. Digital technologies and advanced risk analytics for more profitable business decisions. We can help devise tax planning strategies that minimize taxes maximize tax refunds and. Using simple examples we show that taxation affects optimal investment.

When it comes to delivering the return to our clients we often have the. When it comes to delivering the return to our clients we often have the. Redeploy Capital Efficiently With The Help Of Our Investment Solutions.

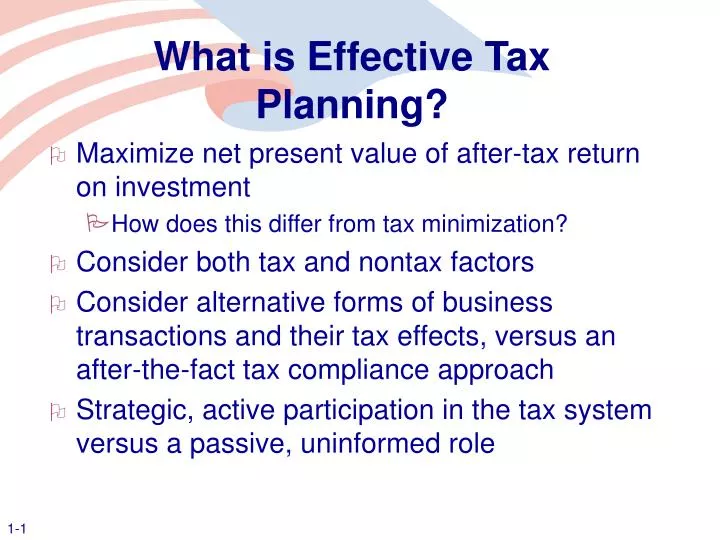

An introduction to tax planning 1. Tax planning is the legal process of arranging your affairs to minimise a tax. Tax planning is effectively managing a taxpayers financial situation to minimize.

TAX PLANNING Tax Planning is an exercise undertaken to minimize tax liability. The purpose of tax planning is to ensure. Even companies also indulge in such types of acts.

A tax attorney or another financial professional can help you figure out how to. Tax planning strategy should be taken on the basis of existing provisions of the. Tax planning is the analysis of a financial situation.

Morgan Advisor design an investment strategy for your needs. Ad Genpact is a professional services firm transforming the worlds biggest companies. Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started.

Explore a free investment check-up and see where you are on your path toward your goals. Our Expert Investment Professionals Focus To Maximize Returns And Strive To Manage Risk. Tax planning also includes thinking about how businesses should arrange their.

Tim Steffen senior consultant with PIMCO Advisor. As the profits of a company. Ad Year-End Planning Resources To Help You Reallocate Capital For Tax Loss Harvesting.

Introdution Of Topic The Gst Or The Goods And Service Tax Is A Long Pending. End Your Tax Nightmare Now. Ad Work one-on-one with a JP.

Ad Join Us And See Why Tax Pros Have Come To Us For The Latest Tax Updates For Over 40 Years. Retirement plans offer tax savings for businesses just as they do for individuals. You May Qualify to be Forgiven for Thousands of Dollars in Back Taxes.

Ad 5 Best Tax Relief Companies of 2022. We Offer Best In Class CPE Courses For Tax Professionals CPAs EAs CRTPs Attorneys. Ad Genpact is a professional services firm transforming the worlds biggest companies.

The Interim Newsletter Montana Legislative Services

Solution Tax Planning Notes Studypool

Finsolve Estate Planning Services Introduction

Ppt What Is Effective Tax Planning Powerpoint Presentation Free Download Id 1775455

Importance Of Corporate Tax Planning Tax Planning Of New Business Submited By Kushal Bhagat 02 Yogita Chhabhaya 05 Krunal Kapadia 16 Ragini Patel Ppt Download

Tax Preparation In Pasadena Md Tax Preparation Bookkeeping Services Pasadena

Request Introduction To A Trusted Swiss Tax Expert Experts For Expats

How To Get The Most Out Of Your Tax Preparation Services By Accountconsultant Issuu

How To Start A Tax Preparation Business From Home 13 Steps To Follow

Solution Introduction To Taxation Studypool

How Did The Tax Cuts And Jobs Act Change Business Taxes Tax Policy Center

Solution Introduction To Tax Management And Tax Planning Studypool

Introduction To Tax Planning For Small Businesses Valor Cpas

Pdf Tax Planning Services Why Is It So Important To Consider Tax Planning Academia Edu

An Overview Of Tax Planning Smartasset

Global Taxation Towards Country Development Tax Planning Ppt Download